This is part one of a three-parts article co-written with innovation-3‘s Frank Mattes.

Organizational ambidexterity is becoming a key factor for success in many industries. With a proper ambidextrous set-up, firms can optimally balance radical and incremental innovation. In this article, we are showing the need for organizational ambidexterity, introduce the concept, show how it can be implemented and provide two case studies from leading german firms.

Radical and incremental Innovation – two types of innovation

At the roulette table, you have to make choices. You can put a little money on different numbers to increase your chances of a moderate payback. Or you can put everything on one or two numbers and hope for the really big win. Managing innovation might look just like roulette – with one crucial difference: You cannot choose not to play at all.

Every firm needs to make its bets, too, when it comes to develop the products, services, processes and business models that will ensure tomorrow’s cash flow. One finds that firms are placing their bets in two ways, depending on the level of innovation that is pursued. In modern innovation management theory, the terms “incremental” and “radical” (the latter also called “breakthrough”) are frequently used to describe the degree of innovativeness of a product, service, process or business model.

Commonly, incremental innovation is defined as the refinement, improvement, and exploitation of existingtechnology, offerings and business models. Incremental innovations build on and reinforce the applicability of existing knowledge and subsequently strengthen the capabilities of incumbent firms and their dominant business design. The management of incremental innovation is characterized by reliability, predictability, and low risk. Examples of incremental innovations include the video iPod, whitening toothpaste, and Microsoft’s Vista operating system.

On the other hand, radical innovations are generally defined as innovations with features offering dramatic improvements in performance or cost, which result in transformation of existing markets or creation of new ones. Typically they are described via “New to the world performance features”, “Significant (5-10x) improvement in known features” and/or “Significant (30-50%) reduction in cost”. Radical innovations build on fundamental technological discoveries and thus are new to the firm and/or industry and offer substantially new benefits and higher performance to customers. In many cases, radical innovations entail the creation of a new business model. Examples include the original iPhone, magnetic resonance imaging (MRI) and the telephone.

Exploration and exploitation: The set-ups supporting radical and incremental innovation

The innovation management systems that firms built up until 5-10 years ago were implicitly aimed at “exploiting” insights and knowledge about existing markets and technologies. In order to achieve this, firms standardized their innovation processes and implemented Phase / Gate schemes, master plans for new Product Development and project portfolio Management – all of these intended to establish control over the innovation process and to minimize the inherent risks in innovation.

True, in the economic textbooks you will find numerous examples for firms that besides implementing these kinds of standardized innovation management systems also introduced radical innovations – but if you look closely, their innovation management systems were not designed to support a systematical search for radical innovations. Quite contrary: Ideas for radical innovations were filtered out regularly already in the early stages of the innovation funnel.

At the same time, the incumbent firms were challenged and a number of industries transformed by new entrants that anticipated needs of not-yet-existing customers and markets and “explored” new technologies, services and/or pursued new business models. Examples can be found in many industries such as Retail (Amazon), Automotive (Tesla, Better Place) or Travel (Expedia).

Firms with a balanced exploration / exploitation portfolio achieve better results

There are at least two strong indications that an optimal balance of exploration and exploitation pays off in financial terms.

Firstly, a joint study done by the universities of Helsinki and Minnesota [Uotila et al.: Exploration, exploitation and financial performance of S&P 500 corporations; Strategic Management Journal, 30 (2009)] showed that for many industries there is an optimal balance between exploration and exploitation. This research shows that the optimal allocation is a function of the industry’s R&D intensity – i.e. the higher the industry’s technology dynamics the higher the payoff of a firm’s exploration-orientation.

Secondly, the Harvard Business Review [Bansi Nagji, Geoff Tuff, Harvard Business Review,http://hbr.org/2012/05/managing-your-innovation-portfolio/] recently mentioned a few studies of companies in the industrial, technology, and consumer goods sectors that focused on the question whether any particular allocation of resources across core, adjacent, and breakthrough initiatives correlated with significantly better performance as reflected in share price.

Indeed, the data revealed a pattern: Firms that allocated in average 70% of their innovation funds toincremental innovations in the core (“safe bets”), 20% to adjacent ones, and 10% to radical/breakthrough/high-risk initiatives outperformed their peers, typically realizing a P/E premium of 10% to 20%. At the firm’s level, the allocation of R&D resources may vary, depending on the firm’s view on the industry, the stage of development and the competitive position.

The 70-20-10 is attractive for financial analysts as well because of what it implies about the balance between short-term, predictable growth and longer-term bets.

Case in point: Google’s co-founder Larry Page told Fortunemagazine that the company strives for a 70-20-10 balance, and he credited the 10% of resources that are dedicated to breakthrough efforts with all the company’s truly new offerings.

The challenge in balancing exploration and exploitation

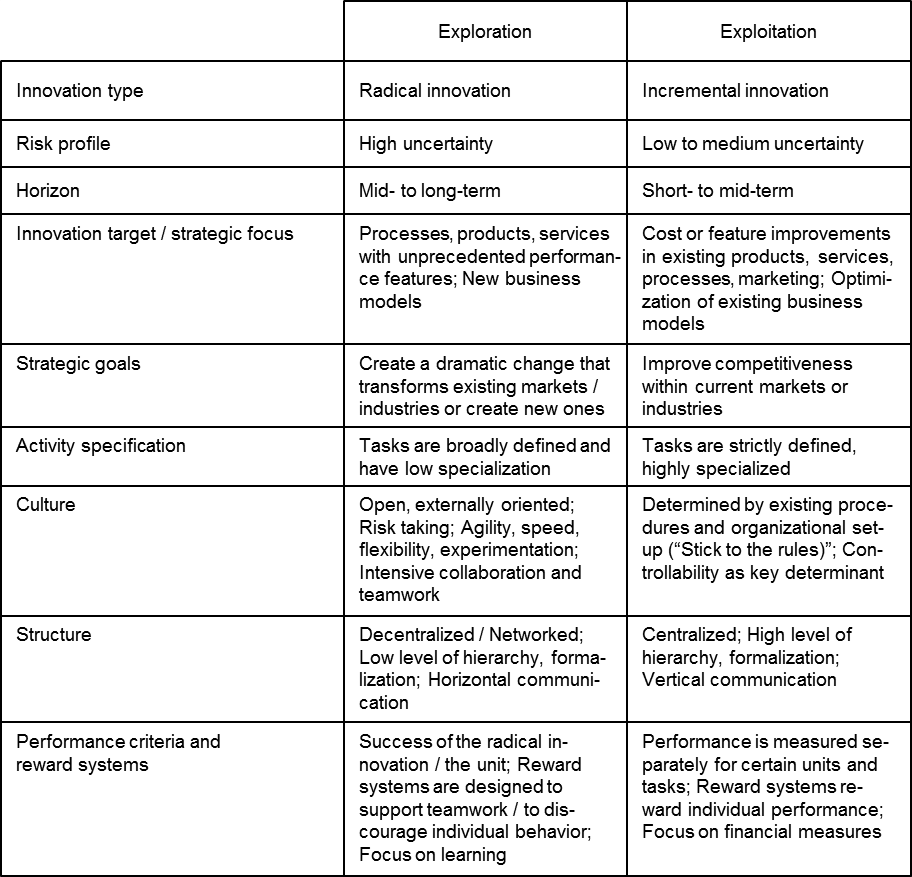

There are a quite a number of dimensions in which exploration is different from exploitation. These extend to organizational, process and cultural dimensions:

This table alone already shows that it will be hard to handle exploration (i.e. radical innovation) and exploitation (i.e. incremental innovation) in one homogenous innovation management set-up.

In practice, firms find that there are two more substantial reasons that make it clear that a better set-up to simultaneously run exploration and exploitation is needed:

- Radical innovations tend to challenge the core product base and the core business model. In many cases, this would negatively impact the Key Performance Indicators on which the firm’s management is measured. Further, radical innovation usually conflicts with core business in terms of performance criteria (e.g. shareholder expectations) and the corresponding resource allocation. Hence in many cases management would object to radical innovations.

- Finally, radical innovations pose a number of management challenges – such as (a) recognize opportunities, (b) live with uncertainty and ambiguity, (c) engage in market learning, (d) develop new business models, (e) acquire resources, (f) transition projects, and (g) value individual initiatives – that are often not addressed by existing management systems.

Organizational ambidexterity: An approach to balance exploration and exploitation

In a broader context, the issues raised with balancing incremental and radical innovation refer to a firm’s decision to deal simultaneously with (real or perceived) conflicting goals such as organizational alignment vs. adaptation; evolutionary vs. revolutionary change or manufacturing efficiency vs. flexibility.

Scientists have coined the term “ambidexterity” for these kinds of “double-faced” dilemmas. The word “ambidextrous” is derived from the Latin roots “ambi” – meaning “both” – and “dexter” – meaning “right” or “favorable”. Thus, “ambidextrous” is literally “both right” or “both favorable”.

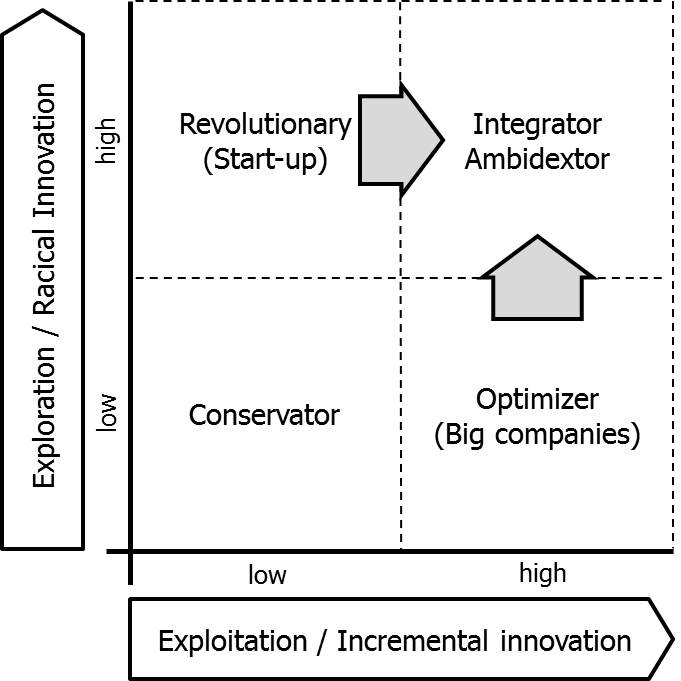

In the innovation context, researches on organizational ambidexterity nowadays are having two basic assumptions. Firstly, the relationship between exploitation (i.e. incremental innovation) and exploration (i.e. radical innovation) is orthogonal rather than two ends of a continuum:

Secondly, even though incremental and radical innovation generally requires quite different mindsets and organizational routines, both activities could still be executed under one corporate roof.

This article was first published at InnovationManagement.se.

[…] exploitation versus exploration, and if you can manage both at the same time, you’re an ambidextrous organisation. It shouldn’t surprise you by now to hear that research shows that firms that manage […]

[…] This is the innovation dilemma most organization face, manage the present while also creating the future: exploitation vs discovery. […]

[…] Related to this balance, simultaneous management of incremental and radical innovation via ambidextrous organizational setups is crucial to build a dynamic innovation […]

[…] outlined in earlier posts, organizations need to balance exploitation (i.e. development of existing business) and exploration […]

[…] One main conclusion of this research is that mainstream and emerging customer orientation should co-exist in order to develop existing businesses as well as prepare for upcoming businesses. The adoption of either a mainstream or an emerging market orientation to the exclusion of the other leads to loss of a certain type of innovation. Balancing customer orientation is another major requirement for organizational ambidexterity. […]

[…] you can see from previous posts, I’ve been passionately advocating the importance of organizational ambidexterity for a […]

[…] this more in detail. In average, the ratio H1:H2:H3 for resource allocation amounts to be roughly 70:20:10. Although this might be a good rule of thumb, a company’s actually required ratio needs to […]

[…] Related to this balance, simultaneous management of incremental and radical innovation via ambidextrous organizational setups is crucial to build a dynamic innovation […]

[…] you can see from previous posts, I’ve been passionately advocating the importance of organizational ambidexterity for a […]

[…] they have already built up. However, they have the resources to conduct experiments in order to explore new fields of businesses, concurrently with exploiting their existing business. IBM with their Emerging Business Opportunity (EBO) intitiave can be seen as a prime exaple for […]